Beware of Phone Scams: Protect Your Account from Fraudsters

As technology evolves, so do the tactics of scammers and hackers targeting members of local credit unions. In recent times, phone-based scams have surged, with fraudsters exploiting trust and fear to gain access to sensitive information or control over funds. These scams, including phone call solicitation (vishing) and text message scams (smishing), are designed to deceive you into revealing credentials or taking actions that compromise your financial security. Here’s how to recognize these scams, protect your account, and stay safe online.

The Rise of Vishing and Smishing

Fraudsters increasingly rely on vishing and smishing to trick victims.

- Vishing (Phone Call Scams): Scammers pose as representatives from a trusted source, law enforcement, or a legitimate company. They often claim your account has been compromised or your debit/credit card has been blocked. These calls are designed to create urgency, pressuring you into sharing sensitive information such as online banking credentials, Social Security numbers, or PINs.

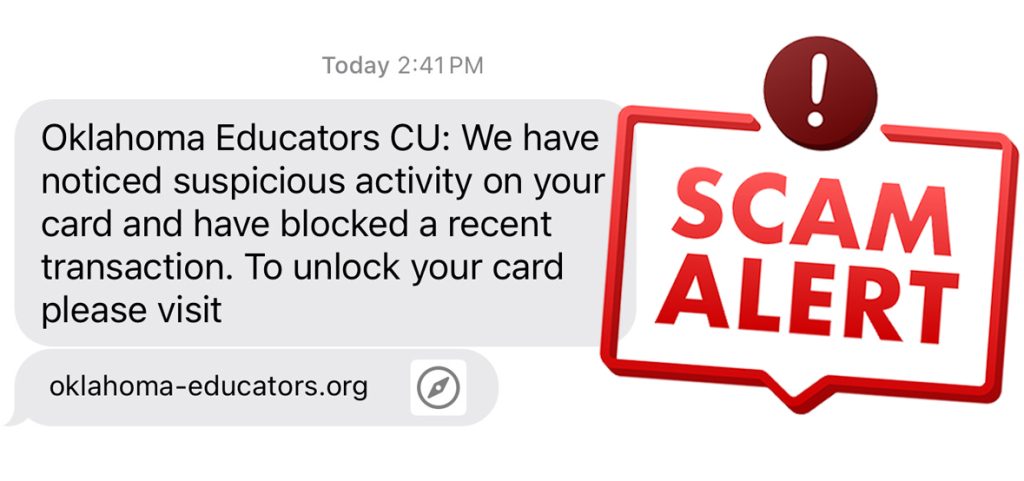

- Smishing (Text Message Scams): Similarly, scammers send alarming text messages, claiming suspicious activity on your account or offering to reactivate a blocked card. These messages often include links to fraudulent websites that mimic OECU’s login page, aiming to steal your credentials.